● Executive / Top Producer Retention Plans

● Pension Distribution - Joint & Survivor option could cost you !

● The 80% Tax Bill

● Tithing into Perpetuity

● Johnny Got More Than Me

● Could This Happen In Your Board Room?

● Employer Receives Tax-Free Money

● How Would You Like To Be In Business With

Your Deceased Partner's Spouse

● Life Insurance, Do You Want the GOOD KIND or the BAD KIND?

● What is an Estate Analysis?

● An Ideal Way for you to pay off your Mortgage Early?

● What makes a widow lie awake nights & children cry behind their mothers back?

● Out living my money

● How long could you hang on if..

● What would happen if your wife died first

● The Story of the Three Horsemen

Executive / Top Producer Retention Plans

If a competitor attempted to lure one of your prized employees away from your company, would you be able to keep that employee?

Various retention arrangements can be used to reward and retain your key executives and top sales producers. Hence, this may prevent them from leaving you to go with a competitor or even start their own business as your competitor. Many owners have found these types of arrangements for a select group of excutives, managers or highly compensated employees such as sales producers can serve as "golden handcuffs" by providing a long-term financial incentive to their valuable employees to remain with the company.

For a briefing, call Roger Ernst or click on Roger@RogerErnst.biz and e-mail you name and work number with the best time to call you.

Back to the Top

Pension Distribution

Joint & Survivor option could cost you !

When you retire, you will most likely elect a joint and survivor payout (if you are married) from your employer’s qualified plan. This option provides payments to you and your spouse for life. However you “pay” for this option.

Your monthly income on a joint and survivor payout option will be less than the monthly income based on only one life. If the monthly income was based on only your life and you die before your spouse, than the monthly income stops upon death. The problem with a joint and survivor option is that if your spouse dies before you, you will remain at the lower amount. You cannot revert to the higher amount even if you’re only retired a month.

In some situations, you can protect your spouse and enjoy the higher life payout option. If you “own” enough life insurance on your life, you can elect the higher life payout. If you die before your spouse, the life insurance proceeds, with an adequate return each year could provide the same monthly retirement payout to your spouse, that you both were enjoying before your death. The key to this strategy is to purchase enough life insurance before retirement when premiums may be more affordable.

For a briefing, call Roger Ernst or click on Roger@RogerErnst.biz and e-mail you name and work number with the best time to call you.

Back to the Top

The 80% Tax Bill

The growth of tax deferred annuities and Qualified accounts, such as pension, profit sharing, 401(k), IRA and 403(b), create a significant tax problem when payments or distributions are made to a beneficiary who is not a surviving spouse. Even though a beneficiary is entitled to a deduction for the estate tax paid on a distribution in respect of a decendent, that total tax bill can exceed 80%. You need make sure that your estate or beneficiary pays the amount of taxes and that they are paid in the most efficient way possible. There is a way. Call…………. Roger Ernst

For a briefing, call Roger Ernst or click on Roger@RogerErnst.biz and e-mail you name and work number with the best time to call you.

Back to the Top

Tithing into Perpetuity

Individuals of often tithe and/or give small donations to charity. Giving to a charity such as your church or synagogue, college, university, hospital and/or medical research fund, Girl Scouts, Boy Scouts, youth groups, senior centers, scholarships, etc will benefit a large number of people and YOU. These may be tax-deductible Charitable Gifts depending on the tax status of the organization. Let’s call a small donation a gift of $2,000. Many people do not hesitate in writing a check for $2,000 to their favorite charity. The gift is always appreciated by the charity, but, unfortunately, a $2,000 annual gift rarely has a large impact on a charitable organization.

Another way to possibly better help a charity is to make cash donations, but ask the charity to use the money to purchase life insurance on you and/or spouse. Depending on age, insurability, and the type of policy purchased, a $2,000 annual premium may provide a charity with a future death benefit of several hundred thousand dollars. 10% annual return on $200,000 of life insurance proceeds would be a perpetual (never ending) $20,000 annually. Think about it! Your name (YOU) and benefiting your favorite church or synagogue or any other charity could possibly live on forever.

Would your church or favorite charity be better off having $2,000 in cash today or receiving a potentially much larger gift in the future?

For a briefing, call Roger Ernst or click on Roger@RogerErnst.biz and e-mail you name and work number with the best time to call you.

Back to the Top

Johnny Got More Than Me

Many parents have more than one child, which can make it difficult to bequeath estate assets equally. Without planning or liquidity, property may have to be sold or children may have to share ownership with each other. This type of distribution can cause problems since children may not get along with each other, and consent may be required by all owners each time a property interest is to be improved or sold.

This problem is manifested when a business owner dies and most of his or her estate consists of business property. Leaving the business to two or more children may cause management problems, particularly when one child is unfamiliar with company operations. There is a solution to this problem.

Estate equalization planning is also important in second marriages. A husband or wife may want to leave property to his her surviving spouse as well as to children from a former marriage. Sometimes it is easier to leave the estate to one party (spouse or children) and apply a most favorable solution many have implemented.

In the event the estate consists mostly of qualified money, it is often better to leave qualified funds to a spouse and apply solution many have implemented to take care of the problem. This distribution plan is usually preferred because only a surviving spouse can roll over qualified distributions to his or her IRA and defer income tax until minimum distributions must be taken*.

IRC 402( c ) (9)

For a briefing, call Roger Ernst or click Roger@RogerErnst.biz to e-mail your name and work number with the best time to call you.Back to the Top

Could This Happen In Your Board Room?

Youthful heirs aren’t so bad, but when they use their inheritance to vote themselves into a position of authority, it may change the direction of your business. Don’t allow outsiders to walk into your business.

For a briefing on the number of ways to maintain control so outsiders won’t move in, call Roger Ernst or click Roger@RogerErnst.biz to e-mail your name and work

number with the best time to call you.

Back to the Top

Employer Receives Tax-Free Money

Many businesses profit because of the talent of key employees. The death of a key employee could adversely affect operations profits employee morale, clients, and lenders. However, one efficient way to help offset these potential problems is to insure the life or lives of key employees. Tax-free death benefits can provide you the employer with resource to replace the key employee and withstand potential losses.

For a briefing on efficient ways to help offset these potential, call Roger Ernst or click Roger@RogerErnst.biz to e-mail your name and work number with the best time to call you.

Back to the Top

How Would You Like To Be In Business With Your Deceased Partner's Spouse or Worse Yet, Your Deceased Partner's New Spouse Who Knows Nothing of Your Business But Wants His or Her Fair Share of the Profits Without Working.

Don't allow outsiders to walk into your business. Maintain control. For a briefing on the number of ways to

prevent this from happening, call Roger Ernst or click Roger@RogerErnst.biz and e-mail your name and work number with the best time to call you.

Back to the Top

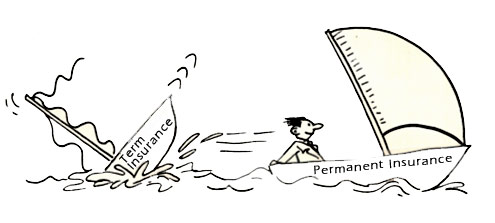

Life Insurance, Do You Want the GOOD KIND or the BAD KIND?

Many have said term life insurance is the Bad Kind since it’s calculated to run out before they need it. True, term offers protection, however as the term period is coming to an end, you’re much older. In some cases you are 20 to 30 years older and still need life insurance but now the renewal premium is out of reach. If the GOOD KIND was initially purchased, then your life insurance would continue for the rest of your life. There are alternatives to the BAD KIND and not the high dollar whole life insurance either.

THE MESSAGE - "Don’t Out live your Life Insurance"

For a briefing on low cost alternatives which can keep life insurance on you for the rest of your life, even if you live to over 100, call Roger Ernst or click Roger@RogerErnst.biz to e-mail your name and work number with the best time to call you.

What is an Estate Analysis?

An Estate Analysis is a hypothetical probate of your estate assuming you died yesterday, illustrating how much creditors and the government may receive before your heirs. An estate analysis is a step before you have an attorney do the estate planning. Further, an analysis can help determine if there may be an estate liquidity problem along with the estimate of the potential taxes due, if any, as of this date. Why pay a fee for this service when Roger Ernst can offer this complimentary service to you. If there are no liquidity problems, you could be home free. You can take the money you saved on a fee and go on a vacation. Please note, this analysis should be done periodically for the most up to date information.

For a briefing on the mechanics of an Estate Analysis, call Roger Ernst or click Roger@RogerErnst.biz to e-mail your name and work number with the best time to call you.

Back to the Top

An Ideal Way for you to pay off your Mortgage Early!

Why Cash Value Life Insurance May Be an Ideal Way for you to pay off your Mortgage Early?

For details, call Roger Ernst or click Roger@RogerErnst.biz to e-mail your name and work number with the best time to call you.

Back to the Top

This is what makes a widow lie awake nights & children cry behind their mother’s back.

Too much of the money she had counted on to meet the high costs of living may be used to meet your high cost of dying. These costs must be paid first, in cash, and they are greater today than most people realize.

Also the loss of your income may be affecting the whole family because you had insufficient amounts of life insurance!

For a review of your needs or possibly a needs analysis, call Roger Ernst or click Roger@RogerErnst.biz to e-mail your name and work number with the best time to call you.

Back to the Top

OUT LIVING MY MONEY

What Will Happen To Me If I Can No Longer Take Care Of Myself? Do I want to burden my children with my care? What Will Happen To My Parents When They Can No Longer Take Care Of Each Other? Will I be able to care for them in my home if asked by them? Will my children be psychologically affected? What Will Happen To My Spouse If I’m No Longer Able To Render Care? What will the quality of life be like in the twilight years?

How many of us have children who make room in our homes to take care of aged, loved ones? How many of us have children who have the proper training or the time to be caregivers? If you think your children have full time jobs now, just talk to someone who has tried to be a caregiver for a loved one. Consider the emotional issues that arise when a son or daughter has to bathe his or her mother or father or wipe them after going to the bathroom. How many of us have children willing to pack up their families and move to take care of loved ones? Perhaps you should look into Long-Term Care Insurance. Policies of today even cover at-home care.

For a briefing on Long Term Care Planning, call Roger Ernst or click Roger@RogerErnst.biz to e-mail your name and work number with the best time to call you.

Back to the Top

HOW LONG COULD YOU HANG ON IF...

You were too sick or too injured to work? Where would the money come from to live on? Without Income Protection Insurance, you risk your ability to maintain your home, pay all your bills, provide for your children if your income stops. Who will contribute to your 401(k)? Your employer? Think again! You? Think again! There are alternative solutions to this dilemma.

Your Disability Could Cause Foreclosure

For a briefing on solutions to this dilemma, call Roger Ernst or click Roger@RogerErnst.biz to e-mail your name and work number with the best time to call you.

Hey, fellas! Could you afford $48,000 to hire these women?

What would happen if your wife who is a full-time homemaker were to die first, leaving you to bring up the children by yourself? Further, if your wife is employed, what happens to your family’s second income if something happens to your wife? Men are astounded when they realize what it would cost them if they had to pay someone to do the things wives do for free. There is a solution to this dilemma.

For a briefing, call Roger Ernst or click Roger@RogerErnst.biz to e-mail your name and work number with the best time to call you.

Back to the Top

Three Horsemen Crossing A Desert At Night….

There is a legend of three horsemen crossing the desert at night. Out of the darkness came a voice commanding them to dismount and fill their pockets with pebbles. After they had obeyed and remounted, the voice declared, “Tomorrow at sun-up you will be both glad and sad.”

When dawn came, they reached into their pockets and discovered not pebbles, but diamonds. Then they were both glad and sad – glad they had taken as much as they had; sad they had not taken more!

And so it is with life insurance!

Back to the Top

Pictures and a percentage of information are from files compiled over thirty years from: MDRT, LAN, CLU Journal, Vernon Publishing Co., R&R Newkirk, newspapers and agents sharing information.

IDEA # 27 | Paying off the

mortgage early with Cash

Value Life Insurance.

IDEA # 46 | Are you aware

there is a plan other than

a 401k, and IRA or Sep that will reduce your taxable income?

mortgage early with Cash

Value Life Insurance.

IDEA # 46 | Are you aware

there is a plan other than

a 401k, and IRA or Sep that will reduce your taxable income?

Site Design: Hurst Web Design.